Why are we involved?

We have witnessed some of the biggest changes in recent human history. Many of these changes we have felt uncomfortable with, for example:

- The increase in using good quality agricultural land to be split up for housing developments;

- Urban sprawl;

- The increase of importation of foods from overseas despite us quality produce locally;

- Environmental degradation;

- Improper Corporate Governance

But what is Responsible Investment?

Responsible Investment is an umbrella term to describe an investment process which takes environmental, social, governance (ESG) or ethical considerations into account. This process stands in addition to, or is incorporated into the usual fundamental investment selection and management process of looking at the financial health of the underlying investments.

Responsible Investments enable you the investor to base your financial decisions on your convictions, end up with solid returns and make a positive contribution to our world.

Demand for Responsible Investment is increasing!

The recent Global Financial Crisis made investors aware of the importance of considering ethics, governance and environmental issues when examining the future worth of any investment.

While Responsible Investment was once considered a fad, today it is very mainstream investment style with responsible investors coming from all walks of life and across all ages.

The Key Findings of the paper “FROM VALUES TO RICHES” released by the Responsible Investment Association of Australasia in November 2017 were:

- 9 in 10 Australians expect their superannuation or other investments to be invested responsibly and ethically.

- 4 in 5 Australians would consider switching their super or other investments to another provider if their current current fund engaged in activities inconsistent with their values.

- 53% of Australians will consider making ethical or responsible investment in the next 1 to 5 years.

Responsible Investment screening

In the conventional investment process, screening is used to reduce the investible universe based on preferred financial criteria such as leverage metrics and valuation ratios. In the case of Responsible Investment however, additional screening includes ESG and ethical factors such as:

Negative Screens – the exclusion or avoidance of an investment based upon:

- The production of excessive greenhouse gas emissions and other pollution;

- Uranium mining;

- Logging native and old growth forests;

- Nuclear Power;

- Fossil Fuels;

- Gaming Equipment;

- Tobacco;

- Alcohol;

- Weapons manufacture and supply;

- Child labour and slave labour; or

- Other human rights abuses.

Positive Screens – the favourable consideration of an investment opportunity based upon these issues;

- Recycling;

- Reduction in resource use;

- Renewable energy;

- Sustainable Buildings; or

- Systems in place to identify conflicts of interest.

Best of sector

This investment style implies that all industries should adopt higher standards of ESG practice in order to meet the expectations of society and to achieve sustainable and profitable business goals. This process does not involve negative screening, but rather those companies with superior ESG performance from across all sectors.

Thematic Investment

Portfolios that contain only investment that adhere positively to a particular sustainability theme such as environmental technology, carbon intensity, sustainable agriculture and forestry, water technology, waste management, community investing, affordable housing, sustainable property and infrastructure, human rights, microfinance or governance.

Impact Investing

This emerging investment style involves actively placing capital in businesses and funds that are directed toward solving specific and significant and social challenges. By leveraging the private sector, these investment can provide solutions at a scale that purely philanthropic interventions usually cannot reach. Success is measured by a combination of financial returns and environmental and social impact.

Engagement with Companies on ESG issues

Engagement is the process by which an investor or asset manager or specialist firm will contact companies to build the business case for better management of ESG issues. Engagement can sometimes involve the formal or informal collaboration with the likeminded investors on common issues that can increase the likelihood of a positive outcome from the engagement process.

Shareholder Activism – Voting and Resolutions

Investors who are active owners will exercise their right to vote and their right to raise resolutions in order to achieve better management outcomes. Investors activism on governance issues has grown substantially in the last ten years, particularly in Britain and the United States, and especially in relation to director elections and remuneration. More recently, environmental and social resolutions have also grown in number and support in the United States and in 2011 Australia’s first dedicated climate change shareholder resolution was brought forward.

“We think green means green. This is a time period where environmental improvement is going to lead toward profitability. This is not a hobby to make people feel good.”

Jeffrey R. Immelt, Chairman and CEO, GE

“This used to be controversial, but the science is in and it is overwhelming……We believe every company has a responsibility to reduce greenhouse gases as quickly as it can.”

Lee Scott, CEO, Wal-Mart

What sort of returns can you expect?

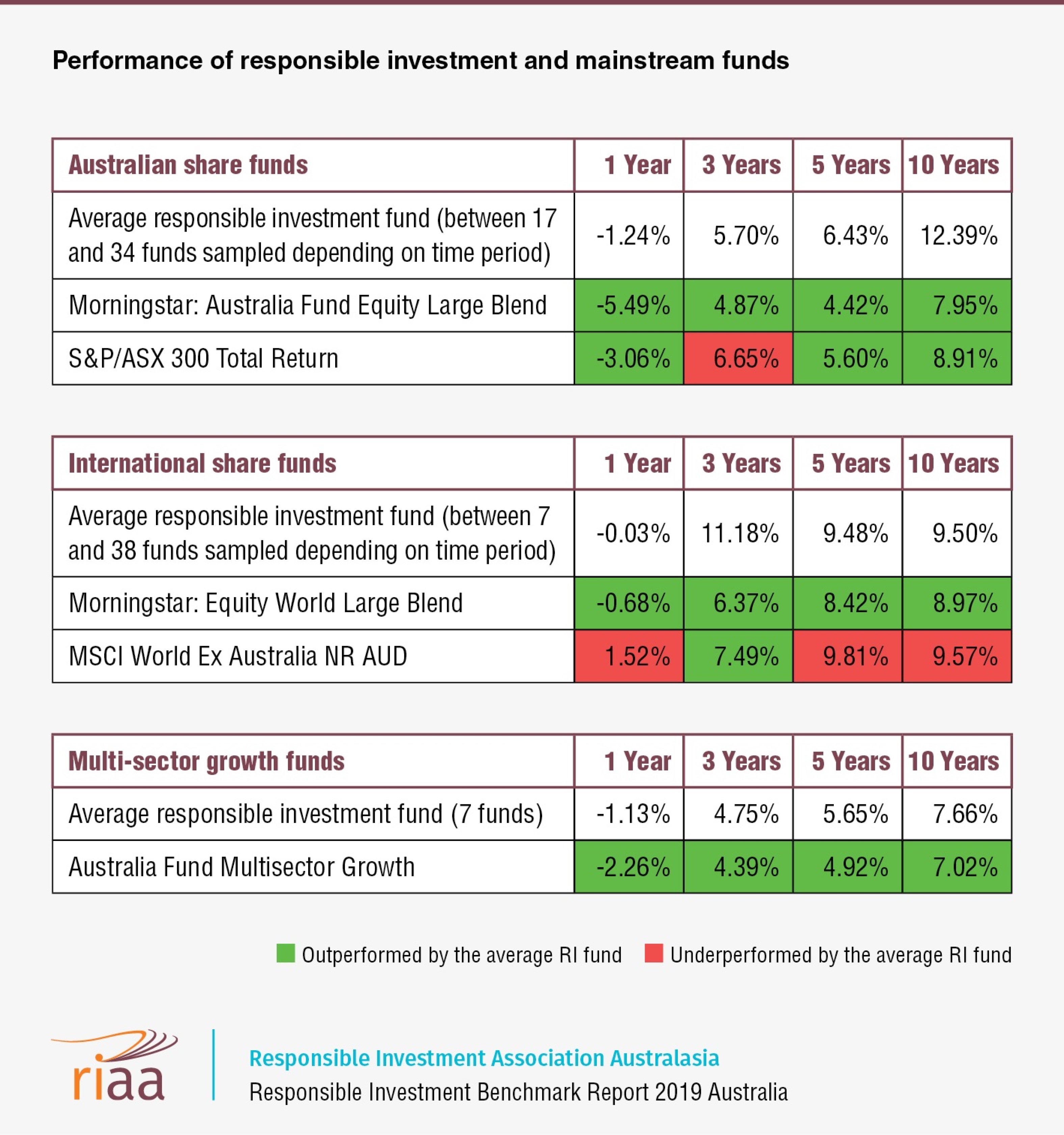

As shown in the table above, domestic and multi-sector Responsible Investment Funds have outperformed average mainstream funds for the periods 1, 3, 5, 7 and 10 years, to December 2018. Responsibly invested international share funds outperformed over longer time horizons but slightly under-performed over the short term.

What is our role?

As every investor has different concerns, at our first meeting we will work with you to identify and document your Responsible Investment Profile. Once this is done we will recommend investment solutions to match your Responsible Investment profile

Useful Links

The Ethical Advisers’ Co-operative Ltd (Co-op) is a member operated organisation created to help you understand ethical investment and see the peace of mind that comes with aligning your investments with your values.

http://www.ethicaladviserscoop.org/

The Responsible Investment Association Australasia (RIAA) is the peak industry body for professionals working in Responsible Investment in Australia and New Zealand.

Looking for Certified RI products and services?

Find organisations that have been certified by RIAA according to the strict disclosure practices required under the Responsible Investment Certification Program.

Find organisations that have been certified by RIAA according to the strict disclosure practices required under the Responsible Investment Certification Program.